For nearly 40 years, Echoing Green has identified its Fellows at the earliest stage of their social innovation journey and helped them nurture their ideas into operational and effective impact-oriented organizations. Indeed, many Fellow-led organizations have gone on to improve countless lives and transform unjust systems, helping tackle the world’s toughest problems.

At the same time, we’ve witnessed how much potential impact goes unrealized because traditional investment and philanthropy models don’t provide the kind of flexible, patient capital social innovators need to scale their work. But what if it didn’t have to be that way? How different would the world be if promising leaders with effective approaches had access to the types of capital they needed, when they needed it?

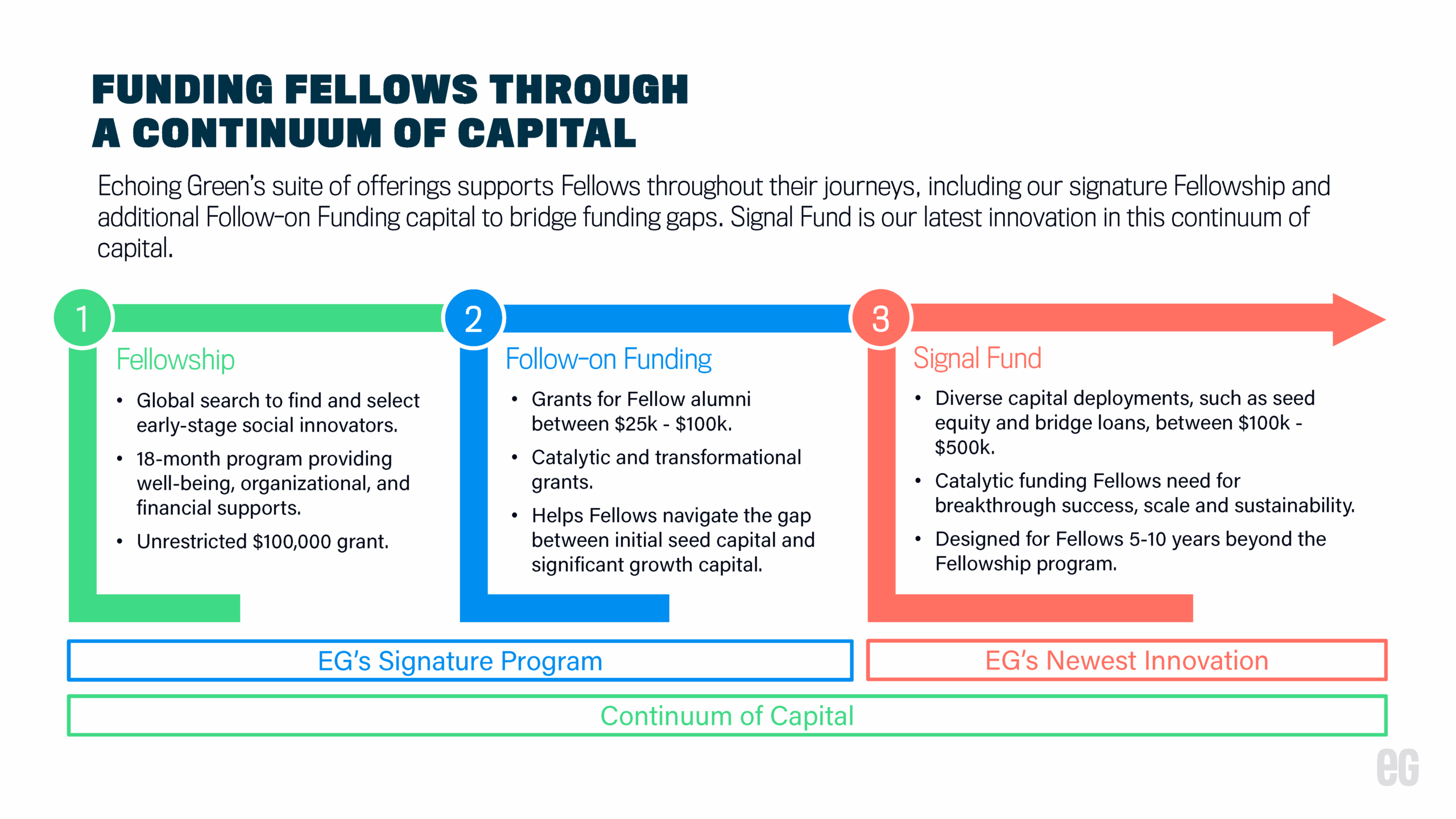

The exciting potential in those questions prompted us to rethink in recent years how the organization invests in Fellows beyond the early-stage funding they receive during their 18-month Fellowship. That first led to our follow-on funding program, which provides grants supporting Fellows as they validate impact and prepare to scale their organizations. To date, Echoing Green has invested more than $13 million in follow-on funding across dozens of organizations.

And two years ago, we launched Signal Fund, which provides a broad range of investment tools for established organizations on the brink of breakthrough impact. Not only has the fund already deployed more than $5M to 18 organizations, it has done so with the rigor necessary to catalyze more than $15M in additional investments for organizations in the fund’s portfolio.